In some countries, it’s required that businesses working with an advertisement or any type of activity that connects the Business to the Customer offering an Online Service, should be paying a certain amount of fee.

If it’s your case and your country determines that you have to pay the taxes for the specific city, state, country…

Let’s us explain how taxes may help you in this process.

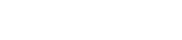

First, let’s header to the Theme Options > Payment Settings > Tax Settings

As we can see, if we define our Tax Rate as 5, the taxes will be added to every purchase of listing or campaign.

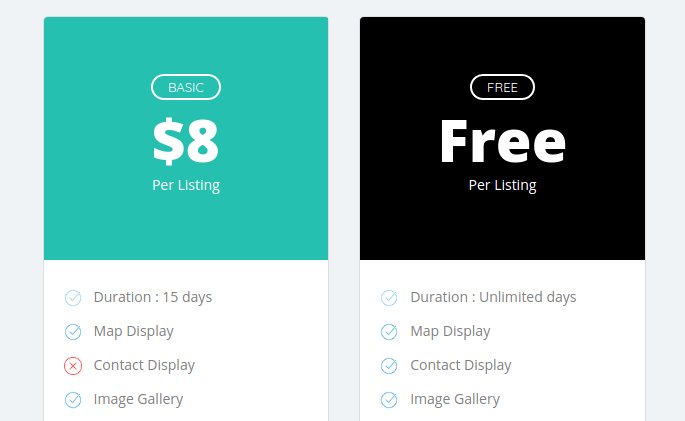

Here, we’re going to include our taxes attached to our Pricing Plans. Later, we’ll show the result without adding it into the Pricing Plans, just to notice the difference between them.

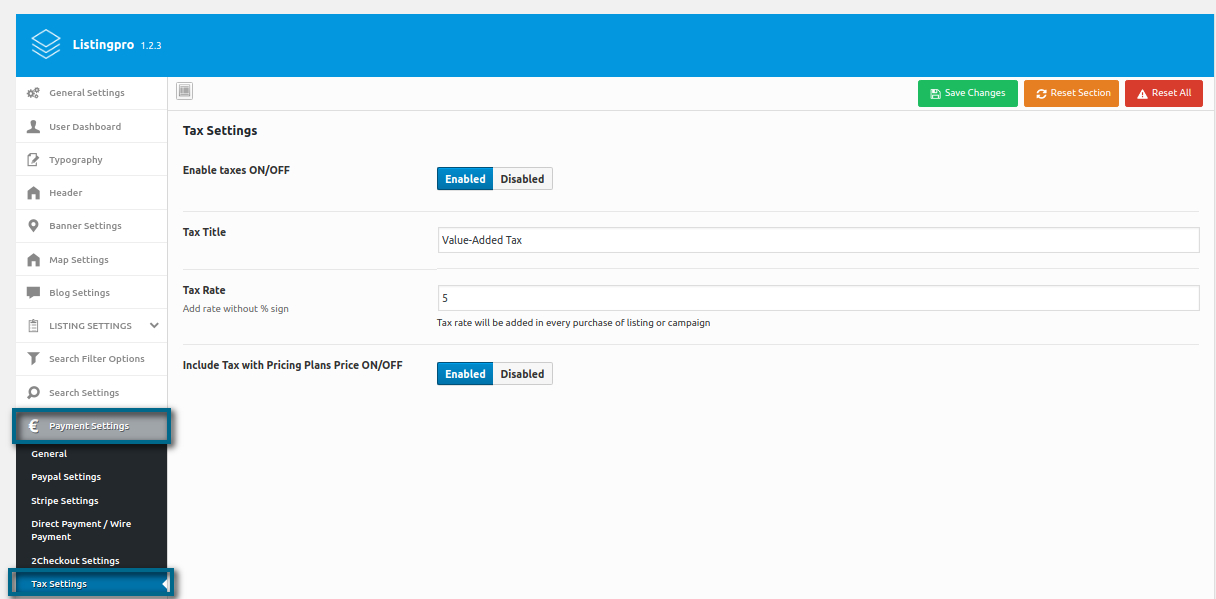

I’ve defined one of the Plan as $8 for 15 days, and the Taxes which was set to include in our Pricing Plans will show the total value as $8.4

See screenshot below

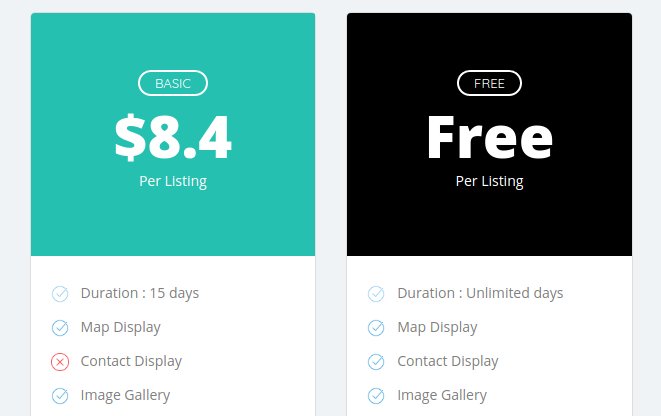

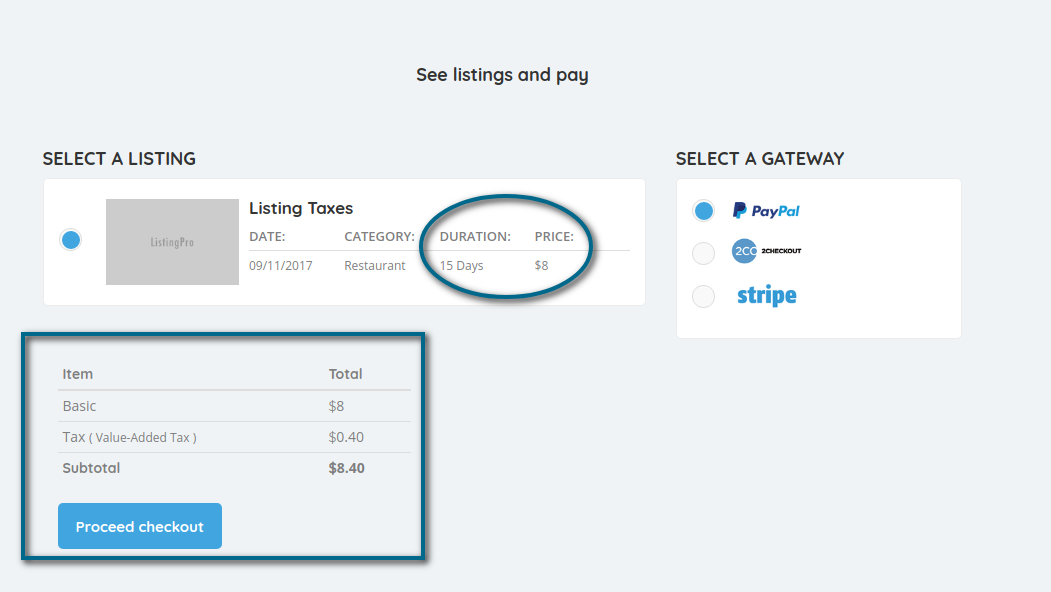

Let’s then buy this Basic Plan, and see which information does it sends back while proceeding with the Checkout Payment.

The result is pretty satisfactory, as you can see the taxes have been included directly in the Checkout Payment.

Now, let’s see the same activity without implementing it into our Pricing Plans. Let’s see how it’s going to give us the Taxes Details.

See screenshot below

As we can see, the Taxes weren’t included in our Pricing Plans. Now let’s see if the result of the Checkout Payment will remain the same or if it’s going to change something in the user-end.

As we can see, nothing has changed in the Checkout Payment, but the minor changes were only noticed in the Pricing Plans.

You can change the Tax Title and include a better description that describes the Taxes on the payments, and also, a good option is to include an FAQ explaining in detail these Taxes.